Many Canadians who incur capital gains taxes, such as small business owners, may only do so once in their lifetimes.

capital gains

Avril 29, 2024

1:04PM

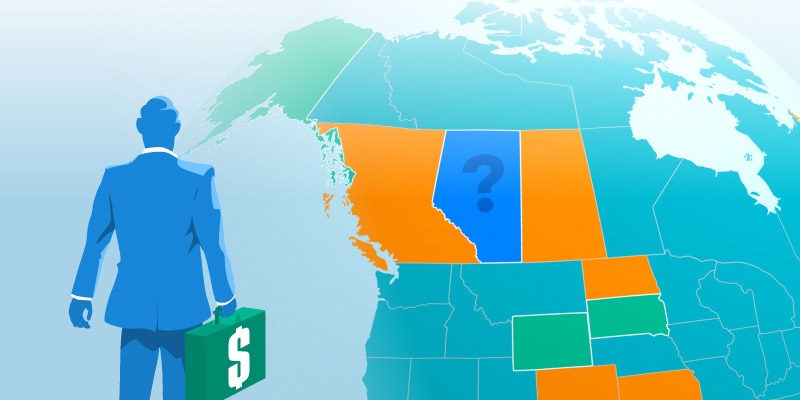

The tax increase will reduce the return on investment and encourage an exodus of capital from the country.

Avril 19, 2024

9:02AM

The province had the third-lowest level of per-worker business investment in Canada.

Avril 18, 2024

2:30AM

Investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate.

Mars 21, 2023

9:19AM

Business investment (excluding residential development) is down 22.5 per cent.

Février 4, 2021

7:27PM

These taxes also apply to Canadians with sporadic capital gains such as businessowners who sell their businesses.

Janvier 21, 2021

8:26AM

Taxes on capital and income are the most damaging to the economy.

Janvier 21, 2019

10:21AM

For most Canadians, capital gains do not show up in income or capital gains statistics.