Federal government should cut taxes in upcoming budget to spur economic growth

According to the Trudeau government’s own projections, economic growth in Canada will remain anemic for the foreseeable future. Indeed, from 2013 to 2022 (the most recent 10-year period of available data) per-person economic growth—a broad measure of living standards—was at its lowest rate since the Great Depression in the 1930s.

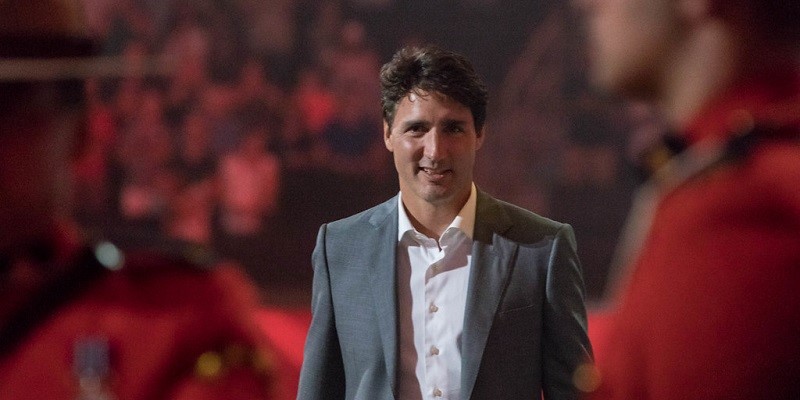

Slow economic growth means slower growth in employment, incomes and living standards for Canadians. But there’s good news. The future trajectory of Canada’s economy is not set in stone and the Trudeau government, which will table its next budget April 16, has several policy options to stimulate growth including tax reform—specifically, reducing income taxes and eliminating several tax credits.

Ottawa has not made meaningful changes to the federal personal income tax (PIT) system in decades. The last fundamental reform to the system occurred in 1987 and most of the changes since then have been incremental and ad hoc. For instance, in 2016 the Trudeau government lowered the second-lowest PIT rate from 22 per cent to 20.5 per cent (while eliminating several tax credits) and increased the top federal PIT rate from 29 per cent to 33 per cent, which significantly hurt Canada’s tax competitiveness, particularly compared to the United States.

As a result, last year among 61 Canadian and U.S. jurisdictions, Canadian provinces occupied the top eight positions for the highest top combined PIT rates. The other two provinces (Alberta and Saskatchewan) ranked 10th and 15th, respectively. All 10 provinces also have some of the highest combined PIT rates in North America at incomes of C$75,000 and C$150,000.

Canada’s tax system has also become increasingly complex over time and requires individuals to dedicate significant time and money to simply comply and file their personal taxes. One main source of this increasing complexity is tax expenditures—the proliferation of credits, deductions and other special preferences in the tax code. The Trudeau government eliminated a number of tax credits in 2016, but almost 150 federal PIT expenditures remain on the books.

Many of these tax expenditures do little to spur economic growth. In fact, layering tax expenditures for certain population groups or activities distorts the tax system and creates biases against individuals who are ineligible for these special preferences. In its upcoming budget, the government could eliminate 49 different federal tax expenditures, which would open up fiscal room and allow Ottawa to lower marginal PIT rates.

For example, due to the revenue generated from eliminating these tax expenditures combined with a modest reduction in government spending, the federal government could eliminate the three middle income tax rates (20.5 per cent, 26 per cent and 29 per cent) and reduce the top marginal PIT rate from 33 per cent to 29 per cent. Subsequently, nearly all Canadians would face a marginal tax rate of 15 per cent while top earners would pay a marginal tax rate of 29 per cent.

These tax changes would make Canadian provinces much more tax competitive with their U.S. counterparts and provide a much-needed boost to the Canadian economy by improving incentives for entrepreneurship, investment, business development and work effort.

Canada’s tax system is in serious need of reform. In its upcoming budget, the Trudeau government should enact a broad-based reduction in tax rates to improve economic incentives, enhance growth and increase living standards for Canadians.

Authors:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.