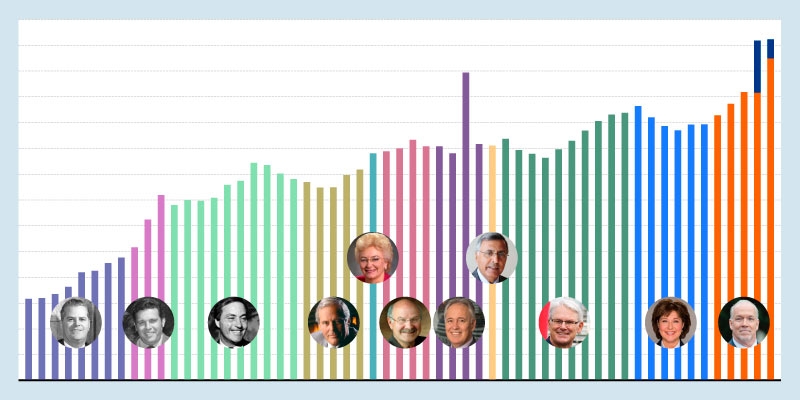

BC Prosperity Research Experts

-

Professor Emeritus of Economics, Simon Fraser University

-

Senior Fellow, Fraser Institute

-

Senior Economist, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Director, Fiscal Studies, Fraser Institute

-

Professor of Political Science, University of Windsor

-

Director, Addington Centre for Measurement, Fraser Institute

-

President, Fraser Institute